Convertible Note Offering

ENDED MARCH 12th

To complete an investment that you initiated before 11:59pm on March 12th, please click the button below or contact us for assistance: investors@fisherwallace.com.

- 20% Discount on the next priced venture capital round (Series A)

- 10% Annual interest rate

- OAK coupon code with investment of $1500+

|

Minimum Investment: $250 |

Quarterly payments begin after 12 months if the note is not converted into equity.

Company Updates

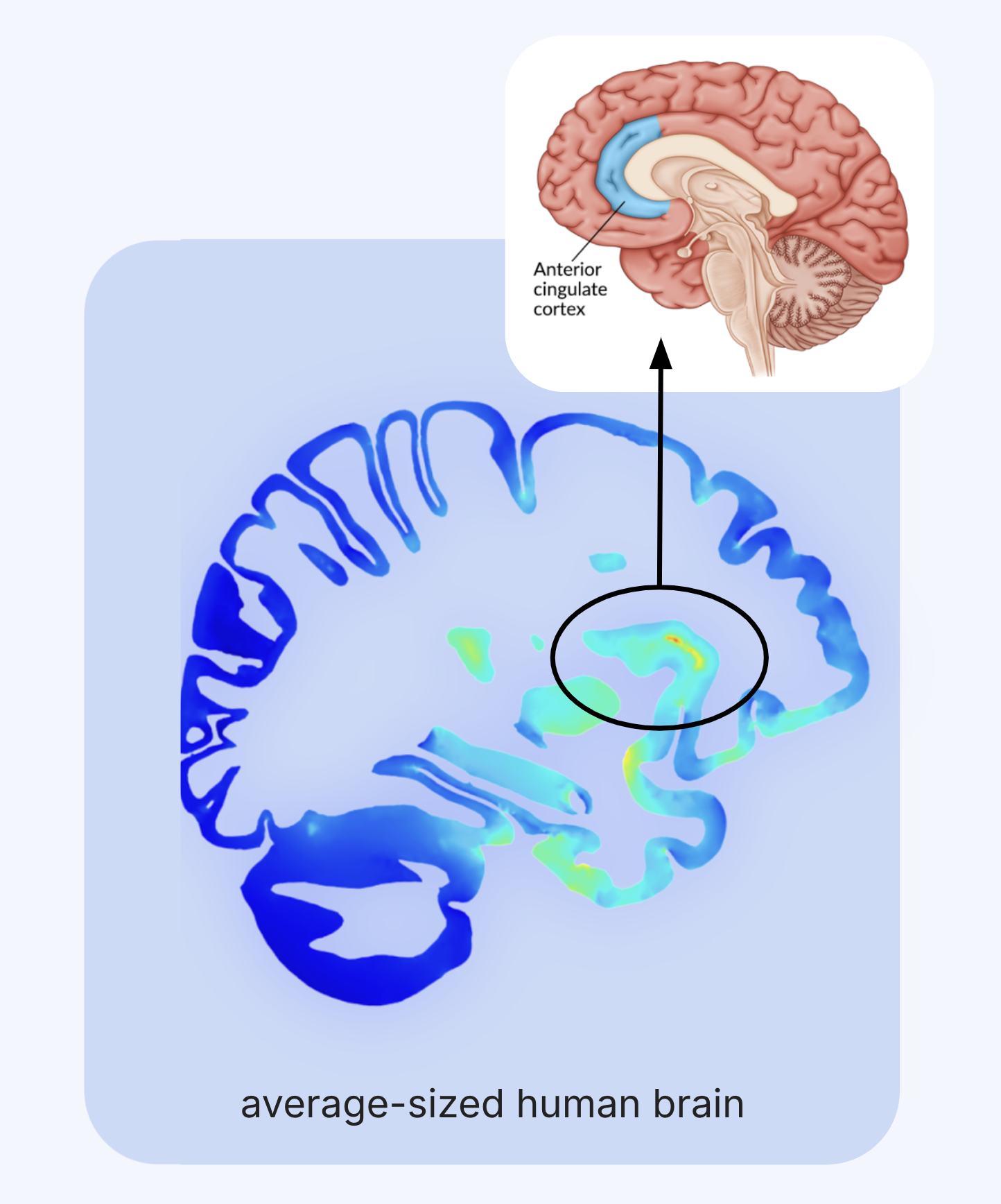

- OAK’s stimulation of the brain was recently modeled by Massachusetts General Hospital and Harvard Medical School, demonstrating engagement of key center brain structures.

- On track to submit our FDA Clearance application for the treatment of anxiety by April of this year.

- We are in the process of setting up a pilot study at the Department of Veterans Affairs.

- Our recent clinical trial data will be leveraged to obtain regulatory approval in Europe.

- We partnered with BlueIO to assist us with venture financing and growth initiatives.

How OAK Works

OAK’s stimulation of the brain was recently modeled by Massachusetts General Hospital and Harvard Medical School, and demonstrates remarkable engagement with the anterior cingulate cortex–the brain’s emotional processor–and other structures that are integral to mood, sleep and cognition.

Designed for New Generations

Gen Alpha and Gen Z exhibit the highest prevalence of depression and anxiety, and adopt new technology more rapidly than older generations. We are currently recruiting a children’s hospital to co-sponsor an adolescent depression study.

A Superdevice for Mental Health and Wellness

OAK is proven to treat depression and anxiety, but its ability to improve cognitive function – enabling people to think clearly – will appeal to an even broader consumer base. Our next clinical trial will measure improvements in cognitive and physical health, in addition to participants’ mood.

For Veterans and First Responders

Dr. David Shulkin, the former US Secretary of Veterans Affairs and CEO of Beth Israel Medical Center, recently joined Fisher Wallace as an advisor to help guide our VA distribution and reimbursement strategy.

The breakthrough results of our Seattle Police Department anxiety study, as well as our published depression study results, will support our efforts to gain VA adoption and help us scale treatment to the more than 4 million First Responders in the US. If you are a First Responder and would like to recommend our technology for a pilot program with your organization, please contact us.

We Proved Product-Market-Fit

Under temporary FDA clearance, Fisher Wallace commercialized its proof-of-concept Version 1.0 device and began making mental health history:

- 100K units sold

- 14K prescribers

- $40M in revenue

- Medicaid reimbursement (MaineCare)

We expect as many as 60K Version 1.0 customers to upgrade to OAK upon its commercial release.

Clear Path to Approval

We remain on a clear path to bring OAK to market next year in the US for the treatment or management of anxiety, and for the treatment of depression the following year. In Europe, we are applying for CE Marks for the treatment of anxiety and depression, using the data we’ve already obtained.

Frequently asked questions

1. Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

2. How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

3. How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

4. What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

5. Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

6. What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

7. Can I sell my Notes?

The Convertible Notes (the “Notes”) of Fisher Wallace Laboratories, Inc. (the “Company”) are not publicly-traded. As a result, the Notes cannot be easily traded or sold. Notes are debt securities that are designed to raise capital from investors, who in turn receive the promise of regular interest payments and the return of the principal amount (the original investment) at a specified future date, known as the maturity date. The Company is offering the Notes with a 10% annual interest rate that is to be paid out in monthly quarterly beginning on June 12, 2026 with a maturity date of March 12, 2027.

8. Can I sell my shares?

The Common Stock (the “Shares”) of Fisher Wallace Laboratories (the “Company”) are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure. Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

9. Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities

• An accredited investor

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

10. What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

11. How can I learn more about a company’s offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

12. What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

13. How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

14. What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.