Invest in Fisher Wallace

THE HARDWARE LAYER OF AI-POWERED HEALTHCARE

OAK®: A Resilience Multiplier for Veterans, First Responders, and the Armed Forces

Milestone achieved: First participant treated in U.S. Dept. Veterans Affairs pilot study

Perks for investing by Feb 6th:

- 135% – 215% Bonus Shares (see below)

- Free OAK® with investment of $1,995.38+

| INVEST |

Share Price $11.21 |

About Fisher Wallace Labs

AI is software—our hardware provides the physical intervention required to rapidly reduce symptoms and optimize brain performance over a patient’s lifetime. We create wearable brain stimulation technology that merges best-in-class industrial design with best-in-class scientific evidence. Our upcoming product, OAK®, designed in collaboration with the teams behind Beats and Nest, has been continuously validated through research collaborations with Harvard Medical School, the U.S. Department of Veterans Affairs, the Seattle Police Department, and other leading institutions. To lay the groundwork for broad insurance reimbursement for patients, we will start by focusing on government procurement for veterans, first responders, and the Armed Forces, alongside serving our community of 14,000 prescribers and the 60,000 active users of our proof-of-concept technology.

Perks for Investing Early

While we prepare for a major institutional VC round following our expected Version 2.0 regulatory approval next quarter, we are opening this exclusive window for our community. Invest now to secure your stake—and bonus shares—before we scale with venture capital.

Bonus share eligibility is determined by the investment amount prior to the addition of the 3.5% processing fee. The minimum investment is: $100.89. A free OAK Coupon Code will be provided with an investment of $1,995.38 or more (one coupon per investor).

Invest: $100.89 – $1,984.17

- Perk: 135% Bonus Shares

- Example: Buy 100 Shares and Receive 135 Bonus Shares for a Total of 235 Shares

Invest: $1,995.38 – $4,999.66

- Perk: 175% Bonus Shares + OAK® Coupon *

- Example: Buy 300 Shares and Receive 525 Bonus Shares for a Total of 825 Shares

Invest: $5,010.87 – $9,999.32

- Perk: 195% Bonus Shares + OAK® Coupon *

- Example: Buy 800 Shares and Receive 1,560 Bonus Shares for a Total of 2,360 Shares

Invest: $10,010.53 – $100,890.00

- Perk: 215% Bonus Shares + OAK® Coupon *

- Example: Buy 1,000 Shares and Receive 2,150 Bonus Shares for a Total of 3,150 Shares

In the National Interest

Mood, sleep and cognitive challenges limit readiness and performance—as a result, there is no question that brain health is essential to national security and public safety. As companies like Palantir and Anduril strengthen U.S. hardware and software capabilities in the defense and other sectors, Fisher Wallace is focused on strengthening human capabilities—whether for individuals in active service or for veterans who have returned to civilian life.

The first veterans have now been enrolled in our pilot program at the U.S. Department of Veterans Affairs, with a leading, active-duty resilience and PTSD treatment site in the process of joining. We previously validated our technology in an anxiety, stress, and resilience study that enrolled 164 first responders, including police officers, firefighters, and EMTs.

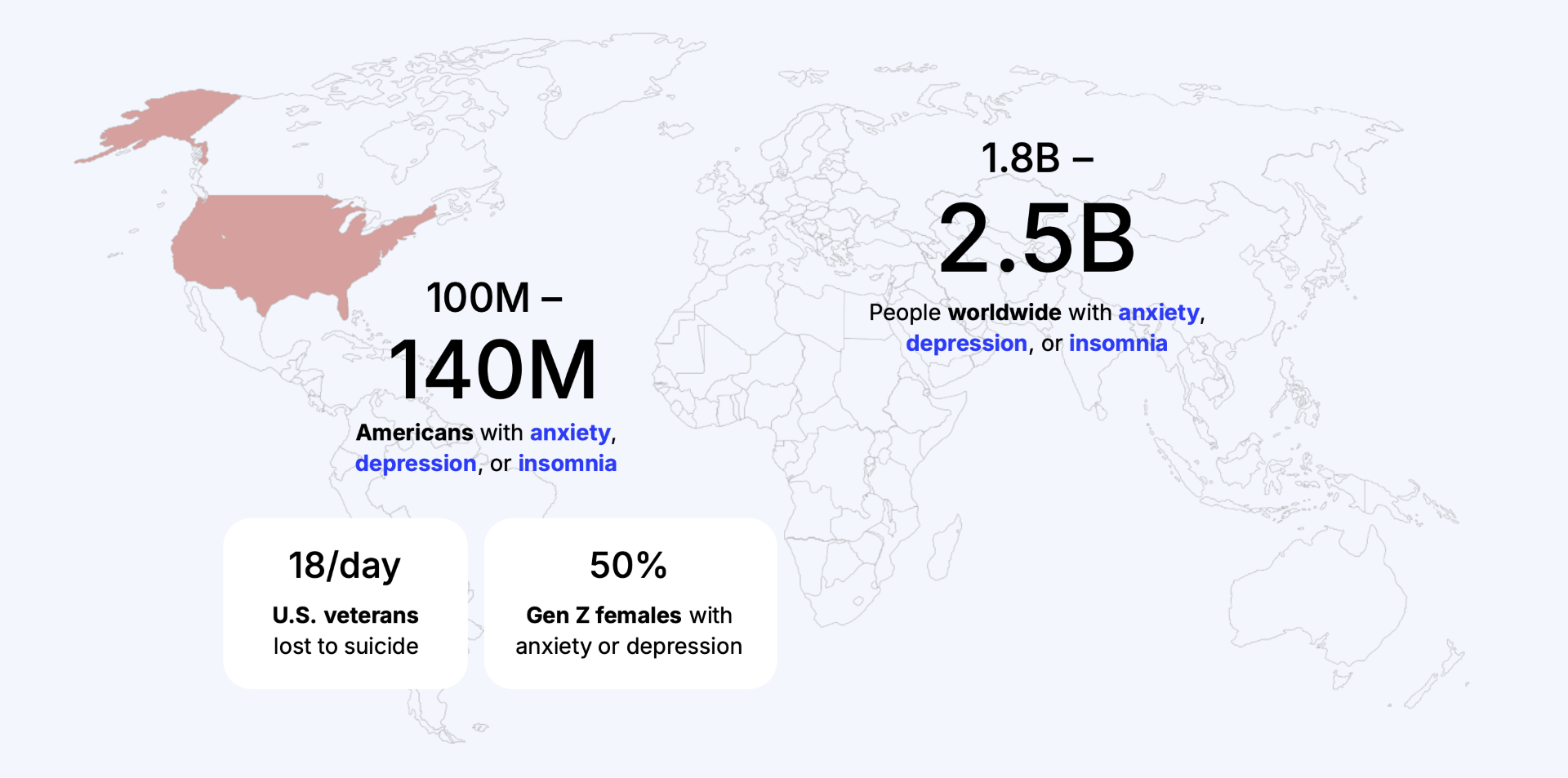

Problems At Scale

Scientific Evidence

An electrical field model generated by researchers at Harvard Medical School and Massachusetts General Hospital demonstrates that OAK® engages the center brain with clinically significant electrical field strength, including the Anterior Cingulate Cortex, Hippocampus, Amygdala, Insula and other brain structures integral to mood, sleep, and cognition.

Our completed clinical research demonstrates effectiveness for the treatment of anxiety, depression, insomnia, PTSD, substance use disorder, bipolar II depression, and Parkinson’s disease.

Advancing Toward Commercialization

We anticipate securing initial FDA clearance for the treatment of anxiety within the next six months. Following this, we plan to commence OAK® manufacturing and secure initial U.S. government purchase orders. Our crowdfunding investors, institutional partners, and select employer pilot programs will be granted exclusive access to the inaugural manufacturing batch.

Gen Z

As many as 50% or more struggle with mental health, and many refuse or are unable to tolerate the weight gain, sexual side effects, and emotional blunting of medication. OAK® meets their needs with a rapid, comfortable, side-effect-free solution—offered in vibrant colors to break the stigma of medical hardware, and make it something proud to be seen wearing.

World-Class Advisors

Dr. Maurizio Fava

Psychiatrist-in-Chief, Massachusetts General Hospital

Chair, Mass General Brigham Academic Medical Centers Psychiatry Department

Dr. David Shulkin

Fmr US Secretary of Veterans Affairs

Fmr CEO of Beth Israel Medical Center

Board Member, Maclean Health

Co-Founders

Kelly Roman

Co-Founder and CEO

15 years neurotech leadership, marketing executive, author, Harvard College graduate, son of U.S. Army Veteran

Charles “Chip” Fisher

Co-Founder and Chairman

Angel investor in Fisher Wallace Labs, Philanthropist, Harvard College graduate, Juilliard Board Member

Frequently asked questions

1. Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

2. How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

3. How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

4. What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

5. Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

6. There will always be some risk involved when investing in a startup or small business.

The earlier you invest, the more risk that is usually present. If a company goes out of business, your ownership interest could lose all value. Your shares may not have voting rights or you may have limited voting power to direct the company due to dilution over time. You may have to wait five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

7. The Common Stock (the “Shares”) of Fisher Wallace Laboratories (the “Company”) is not publicly-traded.

As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: (i) the Company gets acquired by another company, or (ii) the Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return as a result of business failure. Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

8. Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities

• An accredited investor

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

9. What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

10. How can I learn more about a company’s offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

11. What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

12. How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

13. What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

Discussion

Subscribe to Monthly Updates from Fisher Wallace Labs

Contact Us

Fisher Wallace Laboratories

630 Flushing Avenue, Suite 104

Brooklyn, NY 11206

Citations

- National Health and Resilience in Veterans Study (NHRVS). Prevalence of mental-health conditions among U.S. veterans, including anxiety, depression, and insomnia. Updated analysis.

- U.S. Department of Veterans Affairs. “Nearly two in five U.S. veterans meet criteria for clinical or subthreshold insomnia.” VA-affiliated population sleep-health research report.

- Operation Enduring Freedom / Operation Iraqi Freedom / Operation New Dawn Veteran Cohort Study. “41% screened positive for at least one mental-health condition (anxiety, depression, PTSD, SMI, or SUD).” Nationally representative U.S. veteran survey.

- Military Health System Sleep Research Review. “Insomnia prevalence in active-duty uniformed service members is estimated to be nearly 50%.”

- U.S. Department of Defense – Psychological Health Center of Excellence. “Approximately 12% current major depression prevalence in active-duty personnel.”

- Military Sleep Duration Surveillance Study. “41% of active-duty service members report fewer than five hours of sleep per night,” indicating pervasive insomnia and sleep disturbance.

- SAMHSA. 2021 NSDUH Annual Report. 2022.

- NIMH. Major Depression. 2022.

- NIMH. Any Anxiety Disorder. 2022.

- CDC. Sleep Difficulties Among Adults: United States, 2020. NCHS Data Brief No. 436. 2022.

- American Academy of Sleep Medicine. 12% of Americans diagnosed with chronic insomnia. June 2024.

- Gooch CL, Pracht E, Borenstein AR. Burden of neurological disease in the U.S. Ann Neurol. 2017;81(4):479–484.

- GBD 2017 U.S. Neurological Disorders Collaborators. Burden of neurological disorders across the U.S., 1990–2017. JAMA Neurol. 2021;78(2):165–176.

- WHO. Mental Disorders Fact Sheet (2019 data). Updated 2023.

- WHO. Depression Fact Sheet (2019 data). Updated 2024.

- GBD 2021 Nervous System Disorders Collaborators. Global burden of disorders affecting the nervous system, 1990–2021. Lancet Neurol. 2024;23(4):344–381.

- Morin CM, Jarrin DC. Epidemiology of Insomnia. Sleep Med Clin. 2022;17(2):173–191.

- Caponnetto V, et al. Comorbidities of primary headache disorders. J Headache Pain. 2021;22(1):71.

- Hackett ML, Pickles K. Depression after stroke: meta-analysis. Int J Stroke. 2014;9(8):1017–25.

- Broen MPG, et al. Prevalence of anxiety in Parkinson’s disease. Mov Disord. 2016;31(8):1125–33.

- Cong S, et al. Depression in Parkinson’s disease. J Affect Disord. 2022;301:342–358.

Explanation of Perks, Disclaimers, and Broker-Dealer Information

Perk Eligibility

Only investors who have not previously qualified to receive an OAK® coupon in a prior offering shall qualify to receive an OAK® coupon for a total investment amount of at least $1,995.38 ($2,065.22 with the 3.5% Investor Processing Fee) in this Offering. Only one OAK® coupon will be granted per investor, regardless of how many investments an investor makes in this Offering. (The coupon relates to the Company’s Version 2 device, which remains in development).

Perks are based on both timing and investment amount as follows:

Time of the Investment following Campaign Launch

Investment Amount

Perk

Days 1–7

$100.89 – $1,984.17

135% Bonus Shares

Days 1–7

$1,995.38 – $4,999.66

175% Bonus Shares + OAK® Coupon

Days 1–7

$5,010.87 – $9,999.32

195% Bonus Shares + OAK® Coupon

Days 1–7

$10,010.53 and above

215% Bonus Shares + OAK® Coupon

Days 8–21

$100.89

No perks

Days 8–21

$112.10 – $1,984.17

125% Bonus Shares

Days 8–21

$1,995.38 – $4,999.66

165% Bonus Shares + OAK® Coupon

Days 8–21

$5,010.87 – $9,999.32

185% Bonus Shares + OAK® Coupon

Days 8–21

$10,010.53 and above

200% Bonus Shares + OAK® Coupon

Perks will be calculated for each investor based on the total investment amount. If an investor invests multiple times in this Offering, the combined amount of signed and completed investments will determine what perks the investor receives. Perks will be calculated and assigned to investors after this Offering is completed. See Footnote 3 below for more information regarding the qualification to receive an OAK® coupon.

We are completing the proof of design (prototyping) phase for OAK® (Version 2 Device) and are seeking FDA clearance required for commercial distribution, and expect to commence manufacturing and distribute investigational devices for usability testing, confirmatory testing, and pilot studies in 2025 and 2026, prior to commercially distributing the device under regulatory approval; there may be design and production delays which delay manufacturing or distribution. In addition, we may not successfully complete the design and manufacturing or obtain necessary FDA clearance or approvals for the product, in which case the device may never be delivered. We therefore assign no value to this coupon.

Only investors that have not previously qualified to receive an OAK® coupon in a prior offering shall qualify to receive an OAK® coupon for a total investment amount of at least $1,995.38 ($2,065.22 with the 3.5% Investor Processing Fee) in this Offering. Only one OAK® coupon will be granted per investor, regardless of how many investments an investor makes in this Offering.

Days 1–7 include the day this Offering is launched (the “Launch Date”) through 11:59:59 pm Eastern Standard Time (“EST”) (03:59:59 am Coordinated Universal Time (“UTC”) on the 7th day following the Launch Date (February 6, 2026)). Days 8–21 commence at 12:00 am EST (04:00 am UTC on the 8th day following the Launch Date (February 7, 2026)), and end at 11:59:59 pm EST (03:59:59 am UTC) on the 21st day following the Launch Date (February 20, 2026) (the “Offering Deadline”).

The Maximum Investment permitted for a single investor is $129,656.26 (including the Investor Processing Fee).

No Guarantee of FDA Clearance or Manufacturing

There is no guarantee that OAK® will be manufactured or that regulatory permission (such as FDA approval or clearance) that may be required to distribute OAK® commercially will be granted. At present, some neuromodulation devices intended for wellness are commercially available without a prescription and are not regulated as medical devices; however, these requirements may change. Regulatory permission to distribute OAK® may not be granted, and if granted, a prescription may be required.

Risks of Investing in Startups

Crowdfunding investments in private placements—and startup investments in particular—are speculative and involve a high degree of risk. Investors who cannot afford to lose their entire investment should not invest in startups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development, and their business model, products, and services may not yet be fully developed, operational, or tested in the public marketplace.

There is no guarantee that the stated valuation and other terms are accurate or in agreement with market or industry valuations. Any past performance described is not indicative of future results. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and liquidity concerns.

Broker-Dealer Information

DealMaker Securities LLC, a registered broker-dealer and member of FINRA and SIPC, located at 30 East 23rd Street, 2nd Floor, New York, NY 10010, is the Intermediary for this Offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA’s BrokerCheck.

DealMaker Securities LLC:

Does not make investment recommendations.

Is not placing or selling these securities on behalf of the Issuer.

Is not soliciting this investment or making any recommendations by collecting, reviewing, and processing investor documentation.

Conducts Anti-Money Laundering, Identity, and Bad Actor Disqualification reviews of the Issuer and confirms it is a registered business in good standing, but does not vet or approve the information provided by the Issuer.

Contact information is provided for investors to make inquiries and requests regarding Regulation CF generally, or the status of such investor’s submitted documentation. DealMaker Securities LLC may direct investors to specific sections of the Offering Circular but does not opine on issuer-related matters.

Forward-Looking Statements

This website, as well as the Offering Circular, Form C, and any documents contained therein (collectively, the “Materials”) contains forward-looking statements and are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in the Materials are forward-looking statements. Forward-looking statements give our current reasonable expectations and projections regarding our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts.

These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely,” and other words and terms of similar meaning.

The forward-looking statements contained in the Materials are based on reasonable assumptions made in light of industry experience, historical trends, current conditions, expected future developments, and other factors believed appropriate under the circumstances. These statements are not guarantees of performance or results, and actual outcomes may differ materially.

Investors are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements are accurate only as of the date of the Materials. Except as required by law, no obligation is undertaken to update or revise any forward-looking statements.

Past performance is not indicative of future results. Investment is speculative, illiquid, and high risk. Read the Offering Circular for more information.