The campaign has ended, but if you began the investment process you may complete it this week by logging into the investment portal here.

Invest in Fisher Wallace

150% to 200% Bonus Shares (depending on when you initiated the investment)

- Minimum Investment for Bonus Shares: $111.90

- Free OAK Coupon Code with $1499.46+ Investment

| COMPLETE INVESTMENT |

Share Price $11.19 |

The Opportunity

Fisher Wallace Labs has developed the world’s most scalable form of wearable brain stimulation to treat anxiety, depression, and insomnia, and improve cognitive function. The company’s Version 2.0 technology (aka “OAK”) is on track for regulatory approval in early 2026 and is currently being tested at the US Department of Veterans Affairs. Validated in multiple published studies and designed by the teams behind Beats and Nest, OAK is made for smartphone scale.

CEO Kelly Roman discusses crowdfunding, venture capital, and Fisher Wallace’s near term goals.

Company Updates

- Listen to update from CEO Kelly Roman

- Launched: Pilot Program with the U.S. Department of Veterans Affairs (VA Medical Center in Birmingham, Alabama)

- Anticipated date of FDA Clearance: May 2026

- Anticipated completion date of fully functional OAK prototype (with sufficient funding by January): June 2026

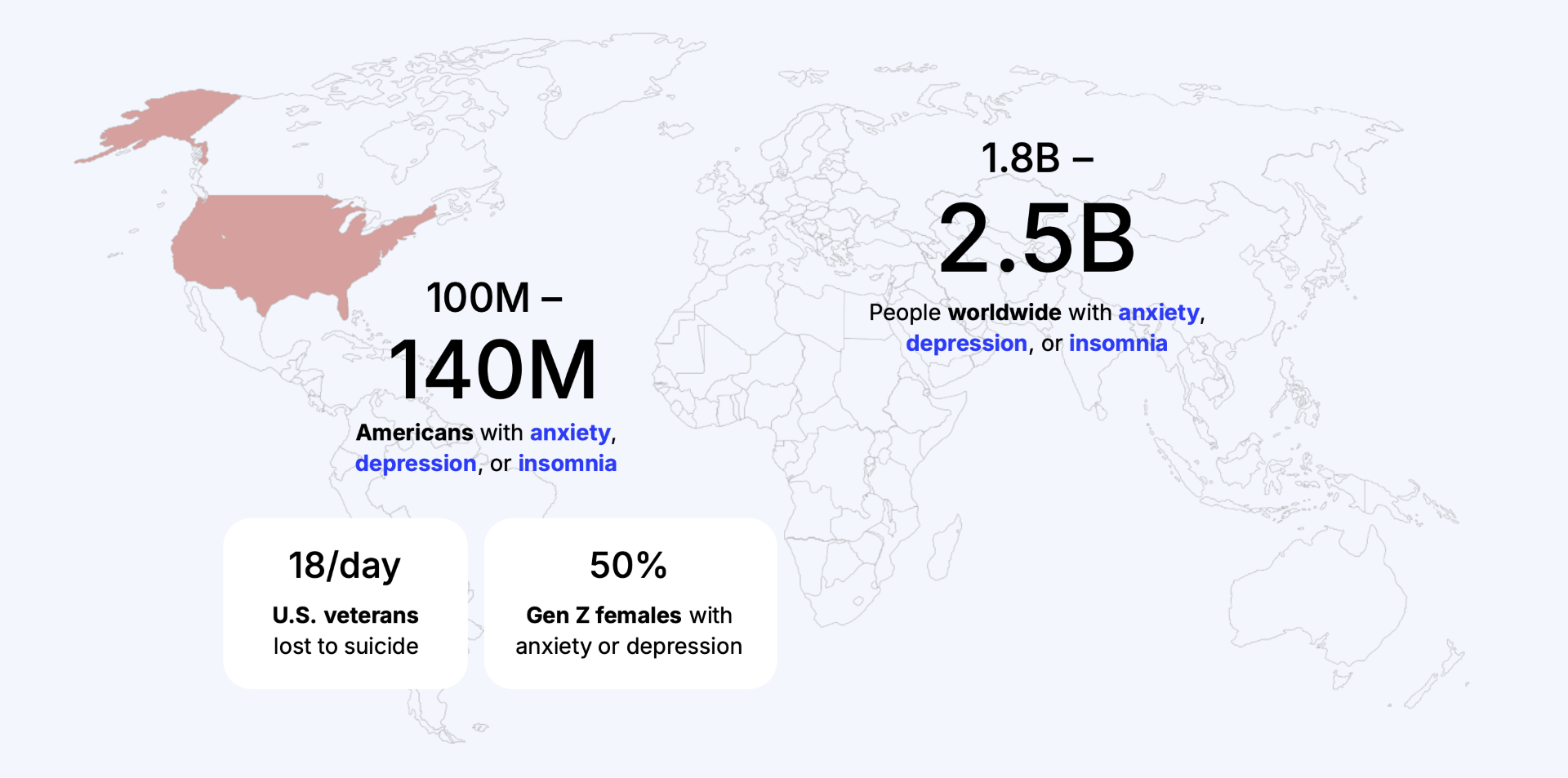

Problems At Scale

Scientific Evidence

More than any other wearable brain stimulation device

COMPLETED for FDA Clearance:

- 8-Week Real World Anxiety Study

Pending Publication

COMPLETED to Validate Pivotal Trials for Depression and Insomnia:

- 4-Week, Randomized, Controlled Depression Study

Published in The Journal of Clinical Psychiatry, 2024 - 4-Week, Randomized, Controlled Insomnia Study

Exploratory Study

ADDITIONAL COMPLETED Pilot Studies: Bipolar II Depression, PTSD, Parkinson’s Disease, Substance Use Disorder

Better Tech For Veterans and Active Duty

With as many as 45% of U.S. veterans and 40% of active-duty service members experiencing anxiety, depression, or insomnia—often co-morbid with PTSD—and with traditional treatments hamstrung by medication side effects, modest effectiveness, frequent dosage changes, multi-drug regimens, high relapse rates, and psychotherapy that is slow-acting, expensive, stigmatized, and constrained by nationwide shortages of qualified clinicians (including long wait times and poor access for rural veterans), both groups urgently need a rapid-acting, safe, self-administered, easy-to-use mental health solution that can be delivered at scale.

Better Tech for Gen Z and Gen Alpha

With anxiety, depression, and insomnia now affecting more than 40% of Gen Z and rising sharply in Gen Alpha—at a time when younger patients are increasingly unwilling to tolerate the weight gain, sexual dysfunction, emotional blunting, and long titration periods common with SSRIs, and when controlled substances such as ketamine or psychedelic therapies are clinically inappropriate or contraindicated—there is an urgent need for a rapid-acting, safe, non-pharmacological, self-administered mental-health solution that aligns with the preferences, safety requirements, and lived experience of these generations.

Business Model

Government procurement expected by Q3 2026

Commercial Insurance, Medicaid, Medicare reimbursement expected by Q4 2027

B2B(2C) Channels

US Departments of Veterans Affairs and Department of Defense

Large Employers

First Responder Organizations

Pro Sports Teams

Outpatient and Inpatient

Direct-to-Patient Channels

Fisher Wallace eCommerce (with integrated telemedicine)

Partnership with Consumer Telehealth / Telemedicine Platform

Influencer Partnerships

Revenue Streams

Hardware

Recurring Digital Health Services via Mobile App

World-Class Advisors

Dr. Maurizio Fava

Psychiatrist-in-Chief, Massachusetts General Hospital

Chair, Mass General Brigham Academic Medical Centers Psychiatry Department

Dr. David Shulkin

Fmr US Secretary of Veterans Affairs

Fmr CEO of Beth Israel Medical Center

Board Member, Maclean Health

Co-Founders

Kelly Roman

Co-Founder and CEO

Charles “Chip” Fisher

Co-Founder and Chairman

Citations

Frequently asked questions

1. Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

2. How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

3. How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

4. What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

5. Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

6. There will always be some risk involved when investing in a startup or small business.

The earlier you invest, the more risk that is usually present. If a company goes out of business, your ownership interest could lose all value. Your shares may not have voting rights or you may have limited voting power to direct the company due to dilution over time. You may have to wait five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

7. The Common Stock (the “Shares”) of Fisher Wallace Laboratories (the “Company”) is not publicly-traded.

As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: (i) the Company gets acquired by another company, or (ii) the Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return as a result of business failure. Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

8. Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities

• An accredited investor

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

9. What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

10. How can I learn more about a company’s offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

11. What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

12. How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

13. What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.